Value added tax (VAT), or goods and services tax (GST) is a tax used by non United States countries that is levied on any product that is added to the cart.

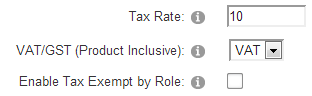

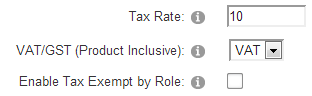

When VAT/GST Tax is selected the following settings will be displayed:

VAT/GST (Product Inclusive) -When VAT/GST Tax is checked the cart will charge the tax rate entered in the “Tax Rate” textbox and implement the VAT/GST tax calculation. You will need to load all product pricing inclusive of VAT/GST tax. During the cart checkout the confirmation pages and invoice VAT/GST is displayed as follows.

Example:

Product 1: $110

Product 2: $55

Sub-total: $165

Shipping: $22

Total (incl. VAT): $187

VAT included (10%): $17

The formula for the tax (VAT) is as follows:

VAT($) = Total($) * VAT(%) / (1 + VAT(%))