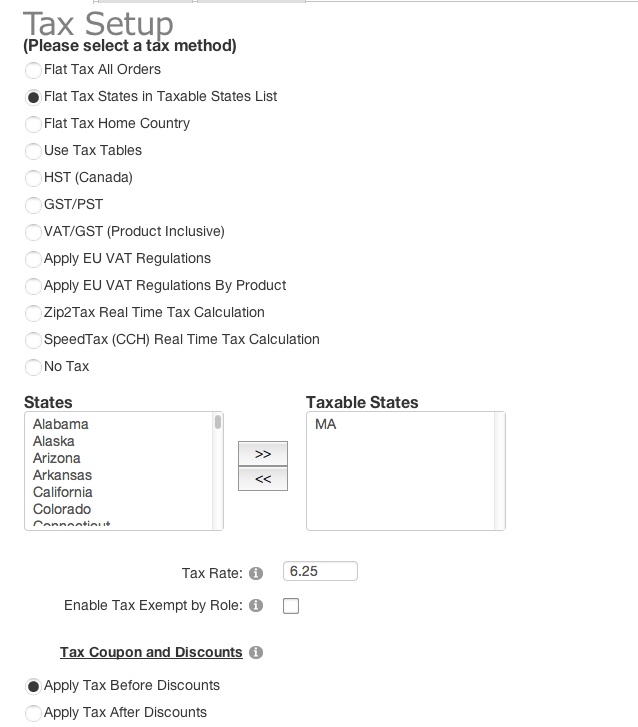

Here are my settings: I just have a simple tax rate for MA.

However, some customers may be able to purchase items tax exempt. To enable this, I have a couple of Variants and associated Variant Groups.

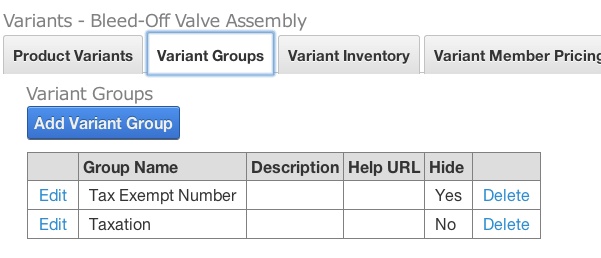

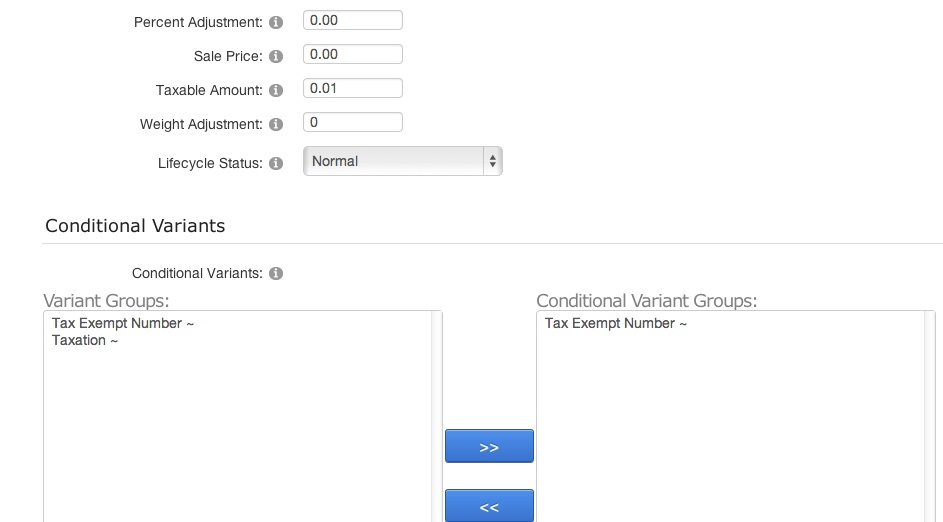

The Groups are Taxation and Tax Exempt Number. The Taxation group represents a Dropdown where the user can select one of two Variants - Taxable or Tax Exempt. The Tax Exempt Number is for a Conditional Variant text box where the user can enter his Tax exempt number. Tax Exempt Number is hidden by default and conditional on the user selecting Tax Exempt from the Taxation Group/dropdown.

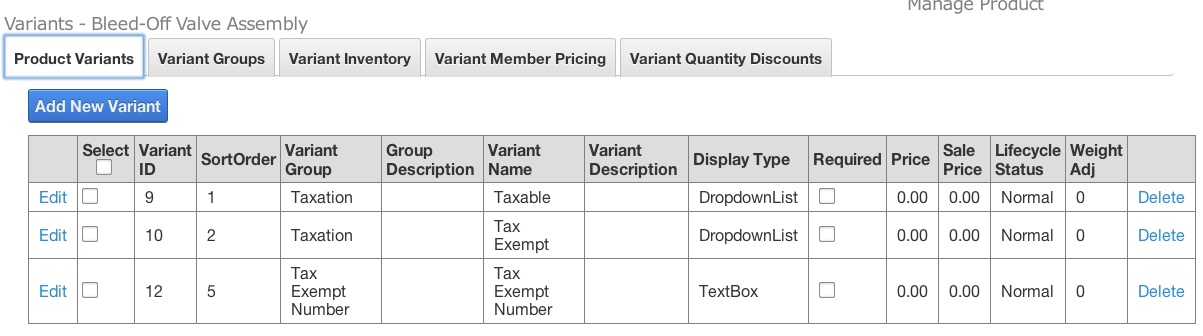

There are three Variants. Taxable, Tax Exempt (group Taxation), and Tax Exempt Number (group Tax Exempt Number).

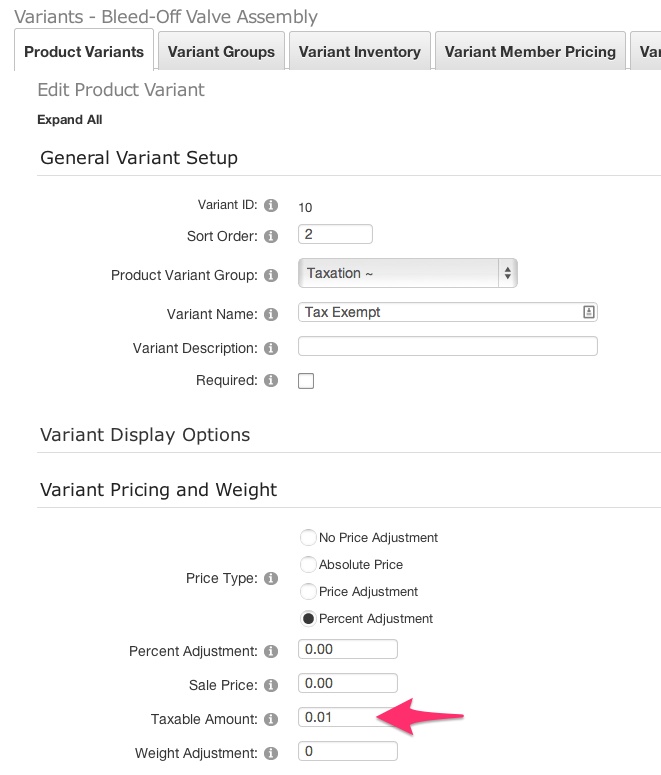

The only one of real interest is the Tax Exempt Variant. That has a conditional Variant on the Tax Exempt Number so that the Tax Exempt Number text box appears when the Tax Exempt Variant is selected. It also has an entry in the Taxable Amount field. Since I want there to be no tax applied when the buyer selects this Variant, I have to somehow force the tax rate (or the calculated amount) to be zero. The only way I could see to do this is to make the taxable amount zero so that 6.25% times 0 equals zero. Well, the field wouldn't take 0 but it would take 0.01 for the taxable amount so that's what I use. 6.25% times 0.01 rounds to zero so it accomplishes the same thing.

This works fine when the product is added to the cart but if I go away and come back to the cart, the tax shows as a non-zero value - basically the product price times 6.25% - effectively ignoring the Taxable amount of the selected variant.

Tom